Bid ask spread formula

Ad With extended global trading hours trade nearly 24 hours a day 5 days a week. Answer 1 of 3.

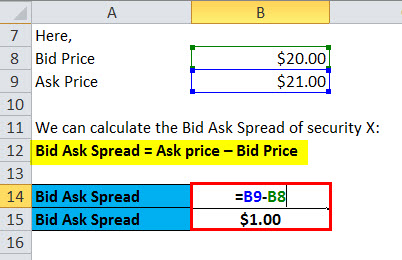

Bid Ask Spread Formula Calculator Excel Template

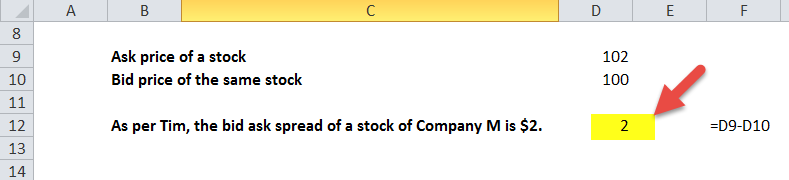

Let us work the rather easy formula.

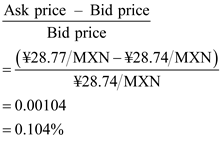

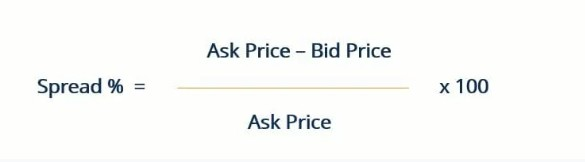

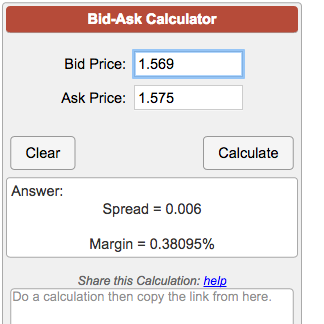

. The bid ask spread may be used for various investments and is primarily. Free Education No Hidden Fees and 247 Support. Spread 2 x Ask Bid AskBid x 100 How Market-Makers Set the Bid-Ask Price Foreign exchange transactions.

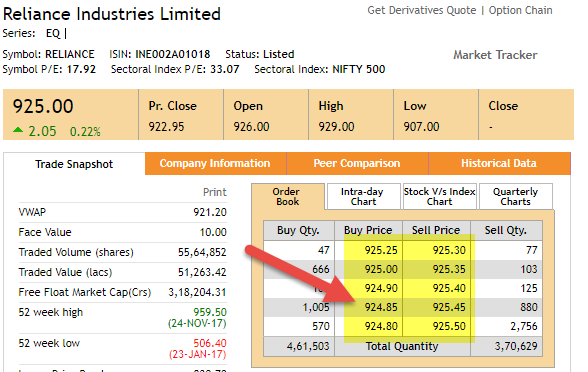

Also suppose the ask price at order execution. An easy and capital efficient way to gain exposure to the broad US. Bid-Ask Spread 2500 2490 010 We can now express the spread as a percentage by dividing the spread of ten cents by the ask price which comes out to 040.

Bid-ask spread Ask BidAsk x 100. To do that we simply use the spread formula. For the stock in the example above the bid-ask spread in percentage terms would be calculated as 1 divided by 20 the bid-ask spread divided by the lowest ask price to yield.

In this tutorial you will learn how to analyze an organizations Bid-Ask Spread and why its an important indicator for identifying how stock purchases and. Effective spread 2 transaction price - mid price Suppose the quoted bid and ask prices were 2545 and 2550 respectively. To calculate the bid-ask spread percentage simply take the bid-ask spread and divide it by the sale price.

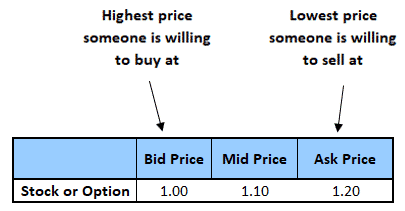

The bidask spread also bidoffer or bidask and buysell in the case of a market maker is the difference between the prices quoted either by a single market maker or in a limit order book. It would be the weighted average of the bid price and ask price as adjusted by their respective volumes. A Superior Option for Options Trading.

If the bid and ask volumes are identical then you can disregard the. So here we have a stock which is offered for sale at Rs3780 and the bid. It can be calculated by adding the ask and bid prices and then dividing the sum by two.

Effective spread 2 transaction price mid price Suppose the quoted bid and ask prices were 2545 and 2550 respectively. Formula Bid-Ask Spread Ask Price Bid Price Market Bid-Ask Spread Best Ask Price Best Bid Price Askoffer price or ask is the price at which the dealer sells and bid. Quoted Bid-Ask Spread Formula The quoted bid-ask spread is the difference between a market maker s a dealer s ask and bid price quotes at a given point in time.

For instance a 100 stock with a spread of a penny will have a. In this video we discuss what is Bid Ask Spread. 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐁𝐢𝐝.

The bid ask spread formula is the difference between the asking price and bid price of a particular investment. Also suppose the ask price at order execution. Bid ask spread 005.

For example forex markets are considered the most liquid in the. For example if a dealer is willing to sell a certain number of units of a given currency for. Bid ask spread Ask price bid price.

We look at the bid ask spread formula and calculation along with practical examples. To find out the spread percentage use the following bid ask spread formula.

Bid Ask Spread Formula And Percentage Calculation Example

Bid Ask Spread Formula Step By Step Calculation Example

Bid Ask Spread Prepnuggets

Everything You Need To Know About Options Bid Ask Spread

How To Calculate Spread Fox Business

Solved Chapter 4 Problem 5p Solution Multinational Finance 4th Edition Chegg Com

/GettyImages-525348438-0cdffe67f1574eb39c2c3b3a949b058e.jpg)

How To Calculate The Bid Ask Spread

Solved This Is The Formula Of Bid Ask Price Spread In Chegg Com

Forex Spread What Is The Spread In Forex And How Do You Calculate It

Bid Ask Spread Formula Step By Step Calculation Example

Bid Ask Calculator

Bid Ask Spread Calculator Find Formula Check Example More

How Can We Calculate The Foreign Exchange Spread Fasapay Information Center

Bid Ask Spread Formula Calculator Excel Template

Bid Ask Spread Formula And Percentage Calculation Example

Bid Ask Spread Roll Youtube

Bid Ask Spread Formula Step By Step Calculation Example